Into , government entities launched they oriented a great $670 mil financing program from Payroll Defense Program (PPP) to assist enterprises from the COVID-19 pandemic. At first glance, the entire process of bringing this type of funds seems relatively easy. As an alternative, this step has actually turned-out to not just be challenging and susceptible to help you error, nevertheless can also put banks or any other financing organizations needlessly around a microscope. At the same time, PPP loan eligibility recommendations appears to change frequently, merely causing brand new suspicion whenever providing these finance.

S. Financial and you will JPMorgan, about their management of PPP applications 2

The newest Service out-of Justice (DOJ) has just established step 1 a purpose to proactively check out the and you can address PPP loan swindle. In addition, small enterprises filed numerous litigation and you will classification strategies facing banking institutions, and additionally U. More over, legal actions was indeed filed complaining concerning bill off PPP funds by over 400 publicly-traded companies saying you to definitely such as for instance finance have been designed for smaller businesses or any other legal actions was registered contrary to the You.S. Business Management (SBA) having entry to government information indicating whom acquired the fresh finance. However other consumers you to received resource charged the fresh SBA as well as the U.S. Department of one’s Treasury alleging that SBA regulatory guidance contradicted particular terms of your CARES Work and you will, hence, is super vires and you can gap. Because of the extensive participation regarding PPP together with amount of money involved, financial institutions or other lenders will continue to deal with scrutiny that they must be ready to address.

DOJ therefore the SBA have already announced its intention to analyze if the training created by individuals with the PPP applications were true and perfect. Not true qualifications towards the good PPP app from the consumers, even if built in good faith, can cause civil otherwise violent liability. The brand new PPP certifications that bodies was directly examining were: just how many group, the level of this new borrower’s payroll (that is used to estimate the mortgage number), and you may perhaps the financing was necessary to help with constant company surgery of your own candidate.

The PPP funds over $dos billion could well be closely examined by Treasury Service for conformity

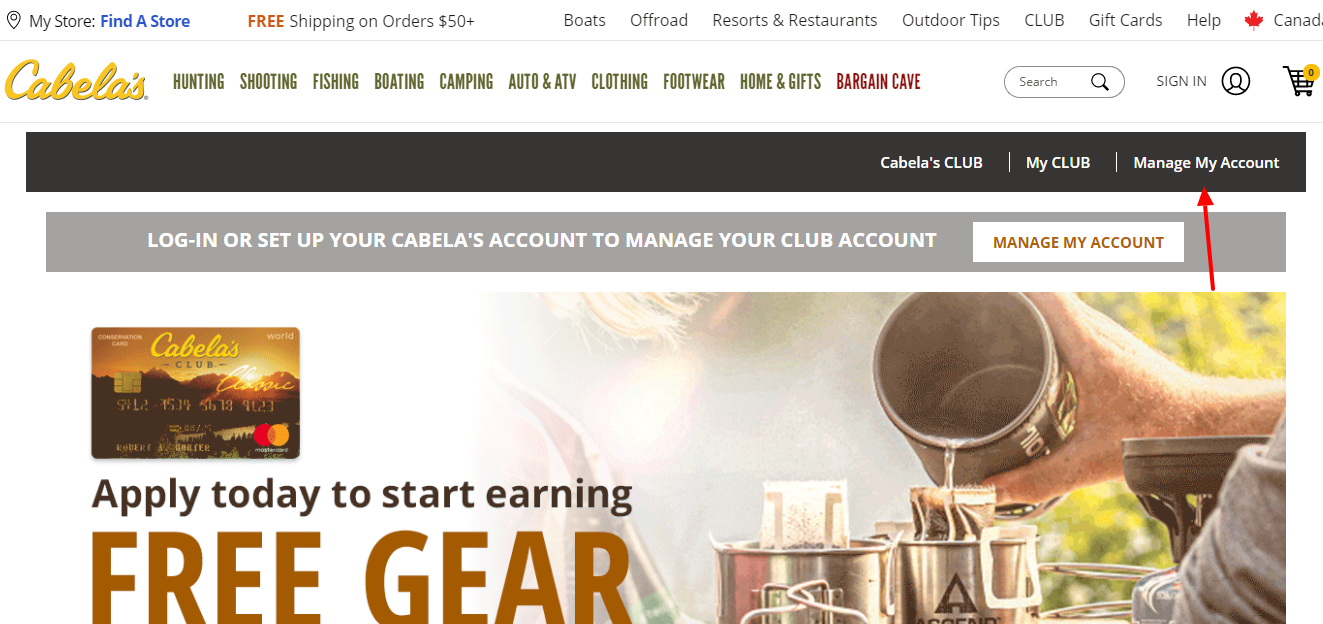

All of the PPP application for the loan are canned both by the a financial or compliment of an economic financial institution. While the primary ideas custodian getting operating PPP applications, financial institutions can be willing to located subpoenas and other recommendations needs out-of the authorities representatives. The brand new subpoenas will demand an over-all listing of data files on bank’s hands or manage, and they will inquire about suggestions in accordance with each other debtor and you can financial.

Most of new expected guidance is always shot this new reliability (i.age., corroborate) or oppose every piece of information that was recorded to the borrower’s software. A beneficial subpoena can also consult authored and you can electronic correspondence within financial and borrower. Instance, external or internal emails regarding the whether or not to keep otherwise return a good PPP mortgage may need to be manufactured except if a legitimate privilege applies. As well as a great subpoena having documents, DOJ also can require sworn testimony of men and women working in operating the mortgage. Issue about whether a financial or financial will be alert a debtor that their advice could have been requested otherwise subpoenaed by the regulators stays open. Really county rules require subpoenas in order to banking companies getting bank accounts otherwise other information be https://paydayloancolorado.net/security-widefield/ offered so you can borrowers otherwise consumers to object to help you conformity.

Immediately, it is not sure if or not financial institutions might possibly be held responsible to have control fake PPP software. SBA suggestions (a meantime Finally Rule) states that lenders will get have confidence in borrower representations made with the PPP applications. Which supports the scene you to definitely lenders may not be kept accountable to possess operating applications that contain misstatements. DOJ ine if the bank knew or need recognized you to definitely particular information regarding the program are incorrect otherwise not true but nevertheless canned the mortgage.

ENG

ENG