These will cost you dont tend to be bank charges or other financial can cost you and you may suppose the borrowed funds will be paid off into base of investment and you may desire at a level of five% appeal

The mortgage label you choose can be determined from the how much you really can afford to pay per month. Borrowers who can afford to shell out even more monthly you are going to like a smaller name, making the overall cost out-of borrowing ?100,000 less costly for them.

The general price of a beneficial ?100,000 home loan may also include very first can cost you like the valuation payment, conveyancing commission and you can a mortgage broker fee (while you are needed to shell out one to).

Getting an excellent ?100k home loan

It is always a good idea to collate your information before beginning to examine financial now offers. Loan providers should know the following guidance:

- Domestic earnings – you should note your revenue as well as people incentives, income and you may benefits that you might located due to the fact mortgage lender usually gauge the funds entering your household against the individuals heading off to introduce whether a mortgage is considering.

- Put count – the degree of put you’ve got stored make a difference to the total amount regarding financial you should buy plus the interest which you are able to spend. More substantial put often improve the loan-to-worth proportion at which your borrow.

- Credit plans – a lending company tend to find out about other personal lines of credit you to definitely you really have in addition to handmade cards, financing and any overdrafts as well as other typical monetary duties such as for instance childcare fees and you can debts. This will help all of them assess your affordability while the top so you can payday loans in Route 7 Gateway CT online that you is financially the full time.

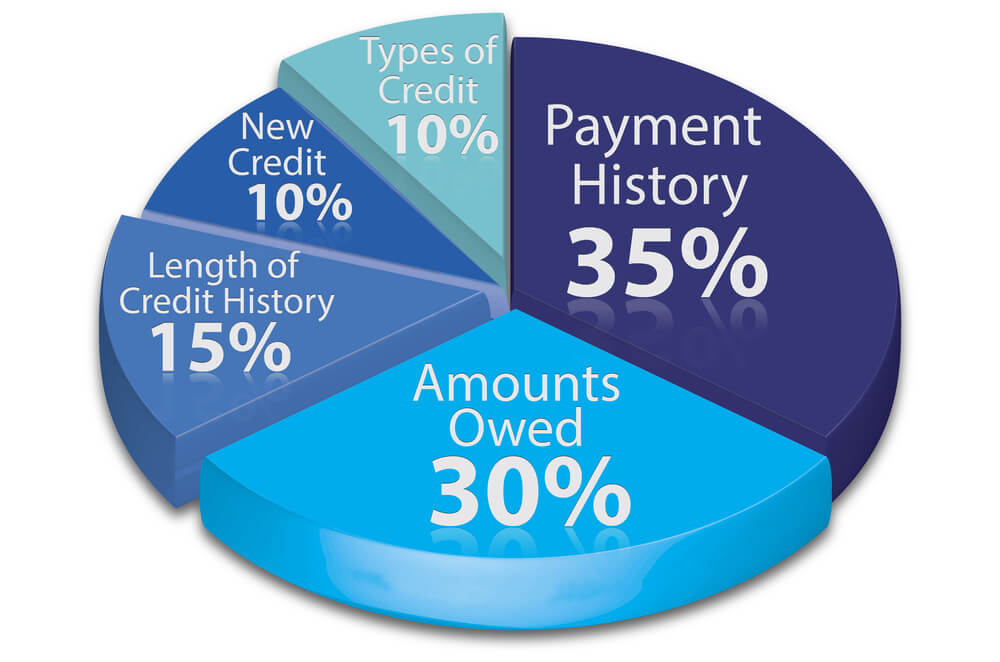

- Credit history – loan providers usually typically check your credit file prior to offering an excellent home mortgage since this will show you your credit rating and alert them to any potential factors you really have got from the past when using borrowing. Your credit report have a tendency to hold factual statements about previous borrowing plans and you will whether you have got had one skipped or later payments filed. Its smart to request a duplicate of one’s full credit report before using, to avoid any awful shocks.

There are numerous strategies that enhance your achievements in protecting a home loan to possess ?100,000. Following the these types of often set you from inside the a beneficial status so you’re able to safer the mortgage that you need to get your possessions.

Step 1 – Collect data files to possess evidence

As part of the procedure for making an application for a good ?100,000 financial, you may be requested to include documents you to definitely evidence your revenue, outgoings and people credit duties you curently have. Really lenders need digital paperwork and is submitted toward a secure webpage.

Step two – Pay back or combine your financial situation

Qualifying to have a mortgage of ?100,000 is based on the website being enough room on your own funds to cover the their mortgage payments. If you’re capable pay or combine your debts, you will would even more space on the cost, making it simpler so you’re able to qualify for the mortgage amount which you you would like.

Step three – Would a funds and then try to eliminate paying

Budgeting is an excellent solution to manage their spending. Listed below are some all of our funds coordinator and you may beneficial funds recommendations inside our post «Budget Coordinator Tips control your money».

Budgeting can assist you to find out how far you are paying, what you’re investing your bank account into the and you will importantly, the place you could possibly make cuts and you will coupons. Effortless wins involve cancelling memberships and other typical repayments you might not you need. And, you may be capable remark typical repayments having qualities including because broadband, entertainment characteristics, portable agreements along with homeowners insurance, car insurance and you will pet insurance.

ENG

ENG