Have you been wanting to know ways to get financing to have a cellular domestic? Realize about the kinds of fund available, how exactly to assess your bank account, and the ways to find a very good finance.

A unique manufactured family pricing on average $76,400 to own a single create in e time, according to U.S. Census Bureau. Should you be provided to purchase a cellular household, this is exactly reliable information to possess, and fortunately you’ll find money offered to help individuals financing a mobile, or are made, house. Exactly how hard could it be locate that loan to possess a cellular family? That confidence every person consumer’s specific situation. It is necessary for mobile home buyers to know what types of fund arrive, how exactly to evaluate its earnings to see which types of fund are around for him or her, and the ways to come across thereby applying for the best mobile house loans. Follow the procedures below, which will show you how buying a mobile house having fun with financing.

Before you start…

The difference between a mobile household and a produced home can also be custom loans Sanford end up being a common part out-of misunderstandings to own buyers, however the change is largely super easy. Become considered a mobile home, it will were factory-built before the regarding this new Federal Cellular Family Framework and you can Security Requirements Operate out of 1974 in addition to HUD Are created Household Structure and Shelter Requirements put inside 1976. Are created homes are those which were warehouse-founded once 1976 as the new coverage conditions was in fact commercially inside the lay. Loan providers have a tendency to stop capital pre-1976 cellular house since they are shorter safe and there can be way more chance your household could be broken otherwise lost. Although not, in spite of the variation, brand new terms and conditions mobile household and are made home are used interchangeably.

You need to note that a cellular financial is actually not the same as a vintage home loan. For-instance, some applications have stricter earnings constraints. Your house may also have to generally meet specific standards. For instance, in case the house is to your tires, it could meet the requirements given that an auto, that can impact the mortgage style of. There will be also dimensions standards towards the house as well as other categories based on the foundation, just for beginners.

1: Evaluate your bank account to check out a loose finances.

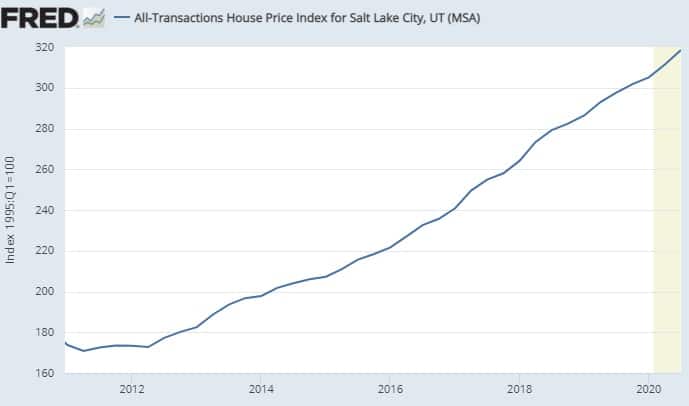

Mobile home buyers that happen to be wondering getting financing to own a cellular house may start from the assessing the funds. They may be able begin by thinking about its credit history, while the which can apply to what forms of funds they be eligible for and will getting an immediate influencer on the rates of interest it pays. Overall, the better someone’s credit rating, the lower the interest prices they may be able qualify for. Borrowers must also observe how far they could reasonably set toward a deposit. Another important foundation is looking during the obligations-to-earnings ratio (DTI), which measures up the level of current personal debt the fresh new borrower features up against its normal month-to-month earnings. The brand new borrower is to assess whether they can take for the mortgage repayments for how far money he or she is bringing in and you can the degree of loans he’s already settling, along with instances when the debtor has actually a top DTI, they could see it harder if you don’t impossible to get that loan. Borrowers can use an on-line are created mortgage calculator to get aside just how mortgage costs and you may details within the welfare cost often fit to their newest budget.

When your debtor discovers that they’re perhaps not inside the a great put economically to consider that loan, they could work with restoring any activities before you apply having an effective loan. Alternatives may include debt consolidating, adjusting lifestyles to fit spending plans, or trying to find an approach to entice a lot more earnings.

ENG

ENG