2. Friends: When you’re less common, relatives may also promote a home loan current letter. Although not, the lender need a letter throughout the pal discussing the fresh matchmaking and exactly why they have been gifting the cash.

step 3. Employers: Oftentimes, a manager may possibly provide a present to greatly help a member of staff get property. This might be in the way of a plus otherwise an excellent one-big date percentage. not, the newest boss should provide a letter detailing that the fund is actually a gift and not financing.

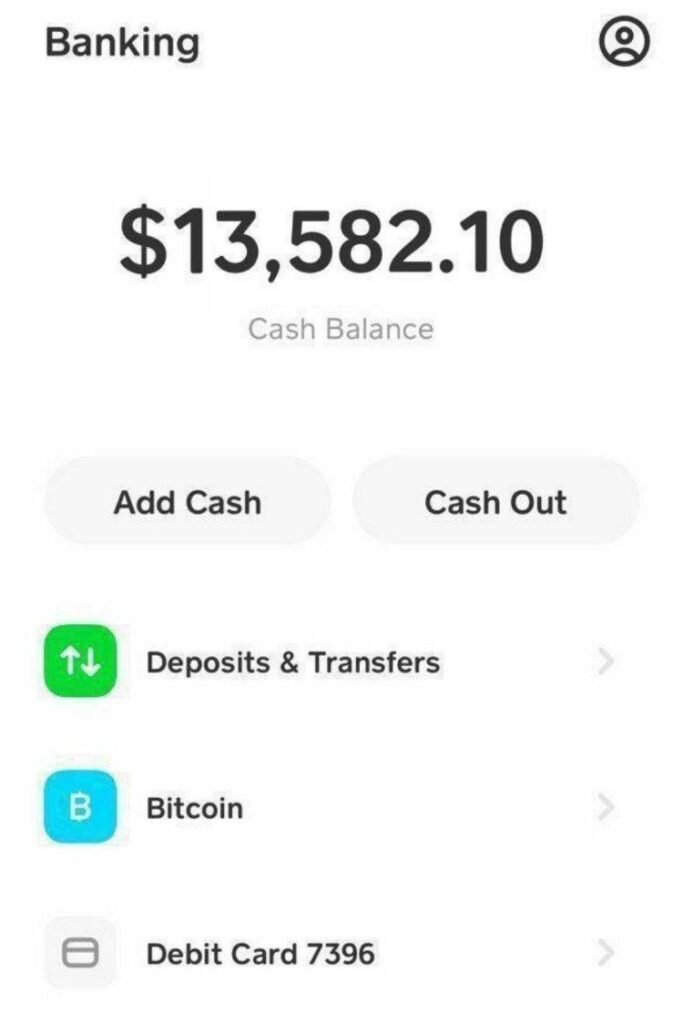

You should remember that anyone providing the provide must likewise have records to prove your funds are arriving of its membership. This might are a financial declaration, a present evaluate, or a cable transfer acknowledgment. By the knowledge who can bring a home loan gift letter, individuals can be make sure he has got every necessary paperwork so you can obtain a home loan.

A mortgage Present Letter is actually a proper file you to definitely confirms the brand new supply of an advance payment current during the a house pick. Its an important document that lenders require to be certain the borrower isnt using up most personal debt to cover the fresh new advance payment. So it page means that new present is really a gift and you will maybe not that loan your borrower was compelled to pay off. There are many reasons precisely why you may need home financing Current Letter. You may well be choosing a present away from a close relative or friend, otherwise that needs the aid of a present. Long lasting reason, it is important to understand the purpose and requires on the document.

In such cases, a home loan Gift Page is necessary to reveal that the amount of money are indeed a gift rather than that loan

step 1. To verify the main cause of your down-payment present: Home financing Gift Letter is actually a formal declaration one confirms the fresh new way to obtain the down-payment present. Its a legal file that shows the lender that fund are something special rather than financing. This new letter ought to include the amount of new provide, brand new big date it was considering, and also the dating amongst the donor therefore the debtor.

dos. In order to conform to lender conditions: Extremely loan providers need home financing Gift Page to make certain that this new borrower is not taking on more financial obligation to cover this new off percentage. So it letter handles new lender’s appeal and ensures that brand new borrower is not overextending themselves financially.

step three. To help you be eligible for advance payment guidance apps: Of many down-payment direction software have to have the access to a gift towards advance payment. Such apps are a great way to help very first-go out homebuyers otherwise people with limited savings to invest in an effective house.

cuatro. Examples of advance payment present supplies: Down payment gift suggestions may come away from a number of present, and loved ones, relatives, companies, charitable organizations, and you will government apps https://cashadvancecompass.com/payday-loans-nh/. It is vital to ensure that the current fits the new lender’s criteria which brand new donor understands the brand new gift’s ramifications.

Overall, a mortgage Gift Page try a critical file which can help you secure a home loan. You should comprehend the requirements associated with the letter and to make sure you feel the necessary paperwork to help you adhere to financial requirements. Whether you’re choosing a gift off a member of family otherwise using a down payment guidance system, home financing Provide Page makes it possible to reach finally your imagine homeownership.

4.How-to Build a mortgage Gift Page? [Totally new Blog site]

Whenever you are to order a property, you will need some assistance to pay for new advance payment and/or settlement costs. That’s where a mortgage provide letter comes into play. A home loan provide letter are a written file showing you to definitely a cherished one or a pal enjoys talented your some money so you’re able to help you get property. It demonstrates on the lender that you aren’t taking right out an enthusiastic additional financing, nor are you presently acquiring money that you’ll have to pay right back.

ENG

ENG