Understanding the part out of pre-degree regarding the financial process is extremely important to own prospective homebuyers. Just like the requirement for this task often is overlooked, it tend to lies the foundation for a informed and you may efficient homebuying journey.

Pre-Qualification: Mode the newest Phase for your house Search

- Budgeting and you will Think : Among the many advantages of pre-degree is it helps you establish a realistic budget for your own domestic research. By having an offer of your loan amount you could be considered having, you might notice your search to the financially possible attributes.

- Early Monetary Insight : Pre-certification has the benefit of a young look into the monetary health from a beneficial lender’s position – eg of good use whenever you are not knowing regarding the creditworthiness or if you will be an initial-go out homebuyer unfamiliar with the loan process.

Emailing Realtors

- Appearing Really serious Purpose : Even though pre-qualification isn’t a formal loan bring, it shows realtors and you will providers you may be serious about buying property – specifically useful in aggressive housing areas, in which providers are more likely to envision also offers of buyers exactly who took initial actions into monetary maturity.

- Assisting Real estate agent Relationships : Real estate agents will prefer working with website subscribers who were pre-certified. It assures all of them that the customer knows their funds restrictions which can be prepared to progress if the correct assets is positioned.

The Limitations out-of Pre-qualification

- Not a loan Make sure : Pre-degree is based on worry about-stated economic pointers and will not cover a thorough credit assessment. Thus, it’s just not a hope out-of financing approval otherwise a deal.

- Susceptible to Transform : The fresh new estimated loan amount and criteria considering through the pre-qualification try at the mercy of changes. Finally financing approval utilizes a more in depth economic comment and you may borrowing from the bank data during the pre-acceptance and you can mortgage underwriting processes .

Navigating the borrowed funds Landscape

- A means so you can Pre-approval : Pre-certification shall be considered a stepping stone on pre-recognition. It makes your towards the deeper financial analysis of your pre-recognition techniques.

- Building a foundation to possess Economic Readiness : Of the skills debt status early in new homebuying techniques, you are able to the mandatory modifications adjust your odds of acquiring a favorable home loan promote later on.

Pre-qualification try pivotal regarding the mortgage process, mode the fresh stage to have a targeted family look and you can creating a foundation to own monetary maturity. Its a crucial step that assists demystify new homebuying processes, enabling you to approach the journey that have deeper Dallas installment loan no credit checks no bank account believe and you may clarity.

Wisdom Pre-recognition

Just after exploring the foundational notion of pre-certification, we have now concentrate on the 2nd important stage regarding home loan journey: pre-approval. Pre-approval is a big help off pre-degree with regards to the breadth of financial scrutiny therefore the level of relationship about bank. Let us demystify pre-acceptance, a switch facet of the mortgage software process that usually suits given that a decisive cause for the fresh new homebuying trip.

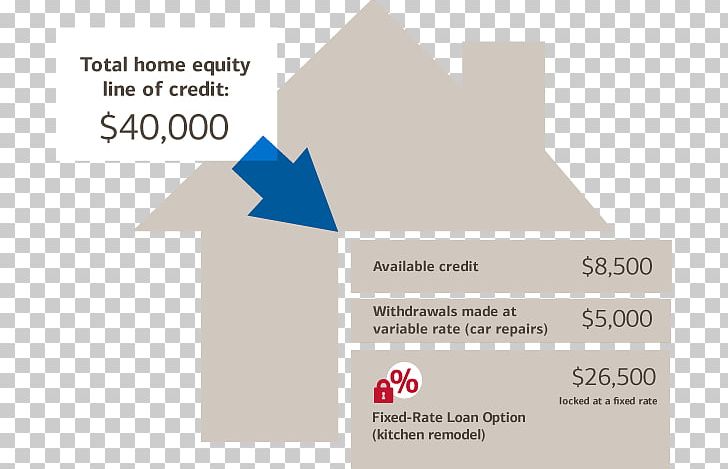

Pre-approval isn’t only an easy extension from pre-qualification; it is a more total plus-depth review of economic situation. This step comes to thoroughly examining your credit report, earnings, debts, and you can possessions from the a lender. The results are a far more real manifestation of your capability to help you safe that loan as well as the terms and conditions which could have it. Understanding the subtleties out-of pre-recognition is extremely important having possible homebuyers seeking to bolster its standing from the aggressive real estate market.

The necessity of Pre-acceptance on Homebuying Procedure

- Improving your To purchase Electricity : A good pre-approval letter try a powerful unit when looking for a property. It gives you an obvious idea of your allowance and you will reveals providers you’re a life threatening and financially waiting visitors.

ENG

ENG