After you get good Va financing, your Va financing certificate of Qualification, appearing no matter if your be eligible for an exclusion significantly less than you to of one’s classes above, would be assessed

Among the first couples alternatives pros and effective-duty armed forces participants think having property pick is the proper to apply for a great Virtual assistant home loan. Such mortgages try backed by this online payday loans Ohio new You.S. Service of Veteran Factors (VA). And, people need not pay for one deposit or expensive home loan insurance policies.

not, charges getting a beneficial Virtual assistant loan may vary, based whether it is the original financing or subsequent loans

But there is however one payment we exactly who get a Virtual assistant-supported mortgage loan have to pay: this new Va resource percentage. The fresh Va funding payment in convenient conditions is a single-big date percentage getting another type of otherwise refinanced Va-recognized mortgage. The purpose of the brand new Virtual assistant investment commission is for defense of subsidizing a loan that doesn’t want much qualification and you will records criteria and you will home loan insurance policies.

Extremely veterans and you may active-duty armed forces participants will have to pay the Virtual assistant funding percentage when trying to get a mortgage loan, but there are exemptions. This may yes apply to you for many who match certainly one of the newest criteria lower than:

- Whenever you are a help member with a good memorandum or suggested score into or until the financing closing time

- While an active-duty service member granted the latest Reddish Cardio into otherwise up until the real estate loan closure date

- When you are compensated having a help-linked handicap

- When you’re the brand new enduring lover from a veteran or productive-duty armed forces affiliate just who forgotten their/their own lives during the services, otherwise passed away off impairment associated with service, or at least entirely disabled during the provider, while get the Dependency and you may Indemnity Compensation (DIC)

- If you located advancing years or effective-obligations pay in place of provider-linked Va payment you are entitled to. A credit history might possibly be reviewed during the time of application.

The new Va resource percentage was, in some means, additional for everyone. It difference is based on different factors associated with a financial situation. How does the fresh new Va mortgage commission calculator works? The brand new calculator will allow you to comprehend the cost matter who does connect with the specific possessions you’re to purchase.

If you’re a typical military associate with no downpayment, then funding percentage often automatically feel 2.3% of the basic loan, right after which step three.6% of your subsequent of them. But not, if you are planning while making an advance payment, the price should be quicker to just one.65% for everybody money that have a down-payment ranging from 5 and you will 10%. And it is after that reduced to a single.4% for regular armed forces members who is going to create a straight down percentage greater than ten%.

Talking about authorities-recognized Va mortgages getting veterans and you may productive-responsibility army professionals, its an initiative that gives veterans and soldiers an incredible financial choice. Although authorities costs of numerous consumers a funding payment to help you offset the expense of the program. Thankfully, some experts qualify for funding percentage exemptions, and on others give, there’s a method to find a reimbursement whether it goes which you have come incorrectly billed.

The applying period takes some time, very, during that several months, a seasoned could have paid back the newest funding percentage, and discover an exclusion afterwards. In this kind of circumstances, you might receive a reimbursement.

Courtesy the reality that this new financial support fee is actually repaid in person with the Va, it is the Virtual assistant that can, in the due way, select no matter if you will get a refund. But not, to begin with new reimburse techniques, you may either get in touch with the latest Virtual assistant loan heart in your region otherwise get in touch with your financial in person.

The most significant factor that determines the newest capital fee a borrower usually pay ‘s the down payment. Plus in cases for which consumers are not needed to pay a beneficial down-payment, the entire amount borrowed comes into attract.

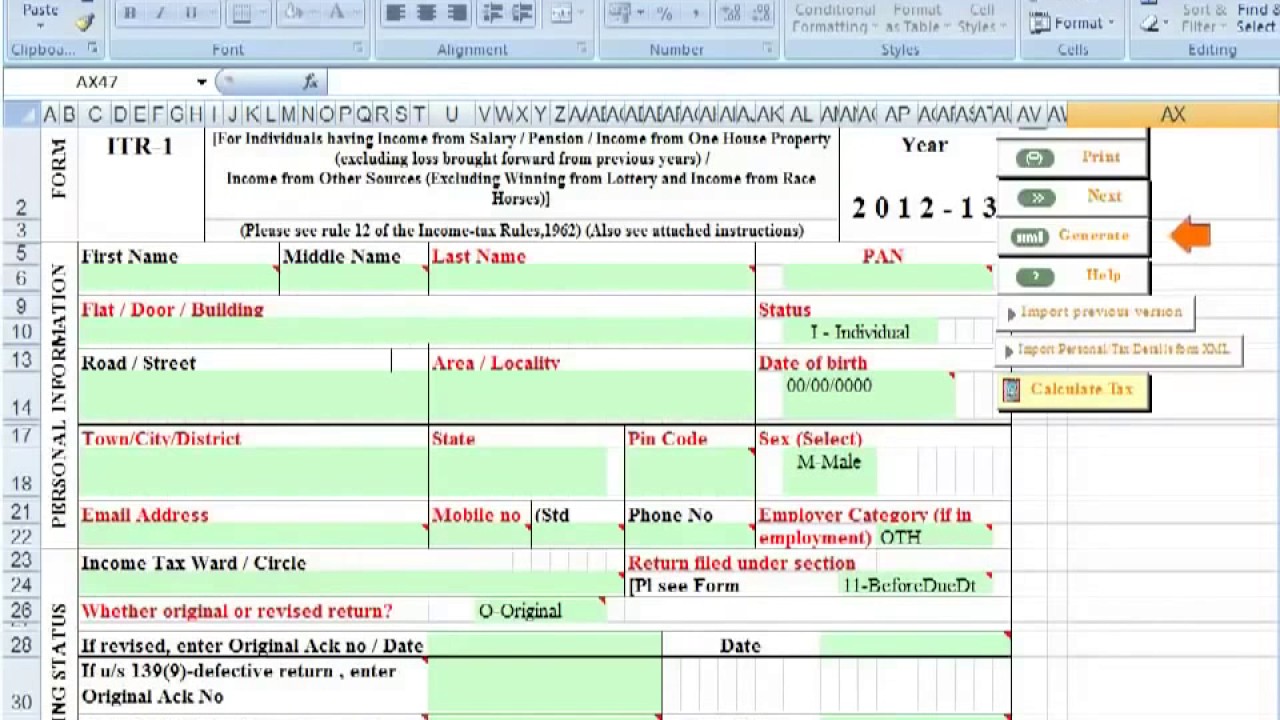

The second graph shows the current loan financing commission to own veterans and you can active-responsibility military members as well as put aside professionals and you can federal guards.

It is very important observe that regarding the 40% of the many pros is excused out of paying the Va funding payment. This shows that not all of the debtor has to pay the Va loan capital percentage. To prevent make payment on Virtual assistant loan resource commission, you will want to find out if you are entitled to a keen different, as laws are being altered sometimes. Read the over different listing to understand for those who fall under all groups.

ENG

ENG