A lot of people mistakenly accept that the fresh new Virtual assistant is the organization you to is actually loaning https://paydayloansconnecticut.com/lake-pocotopaug/ the bucks with the Va borrower, while in reality he’s merely encouraging, otherwise guaranteeing, you to definitely matter for the new borrower towards the bank they is actually credit money from

There are many different items that are misinterpreted about Va mortgage brokers. Mythology, misconceptions, and misunderstandings abound in terms of the fresh new Va financial work with system. Unfortunately, this type of mythology the encircle points that genuinely wish to be really know making sure that a debtor to make the most useful choice regarding their Va mortgage. Discover, of course, enough myths encompassing the spot where the currency having Va money arrives off. In this way, the lender enjoys much less exposure involved in the mortgage and you may may then give you the borrower a better interest rate than just they could otherwise manage to be eligible for.

Another type of common misunderstanding are in regards to the what the fate off good Virtual assistant financing is when a debtor becomes deceased. Given that when it comes to a preliminary product sales, the fresh Virtual assistant ount and then make within the difference so the veteran cannot owe any cash on financial, it’s easy to understand why of several might imagine the Virtual assistant does things similar if the borrower becomes deceased. Although not, that’s not precisely what the Virtual assistant financing experts are designed to have, and you will a thriving mate otherwise offspring shouldn’t predict the newest Virtual assistant mortgage positive points to cover the kept balance on the Virtual assistant home loan. With that said, let us proceed to clarify exactly what takes place in the event of loss of a Va borrower.

New Virtual assistant is fairly clear on their site, proclaiming that although a beneficial Virtual assistant borrower becomes deceased up until the financial is paid down, that the mate or co-debtor will have to continue putting some repayments. The brand new borrower provides the option of providing home loan insurance but that has nothing to do with the brand new Va. From the Va website: The new thriving mate or any other co-debtor need continue steadily to make the repayments. When there is no co-borrower, the loan becomes the obligation of your veteran’s home. Financial insurance can be found but should be bought off individual insurance coverage present. This is certainly a main point here to keep in mind for a debtor and his or her partner otherwise co-borrower once the they’ve been given opening a loan, particularly if the borrower’s wellness is actually less than greatest or probably so you’re able to become worse soon.

Thus in many respects, a great Virtual assistant mortgage is not any not the same as another loans you to a dead individual provides. In fact, its generally identical to a conventional home loan if there is new loss of this new debtor. Whenever a man passes away, its regular for everybody of its expense, and playing cards, student loans, and you may home financing becoming the burden of surviving companion or even the veteran’s estate. In the case of an experienced dying, its basically the same. Since spouse can be entitled to compensation from the Virtual assistant to your death of brand new experienced, no count may come especially throughout the Virtual assistant financing system with brand new intent to repay the balance toward loan. This really is needless to say a very important thing to have Va individuals so you can look out for beforehand. Will, lender’s and other financial institutions will get policies in position to simply help this new surviving partner, especially when the newest dead try the primary money vendor on the house, however, that will result in addition to the Va.

Questions should be answered by a good Va-accepted financial or from the Local Virtual assistant place of work

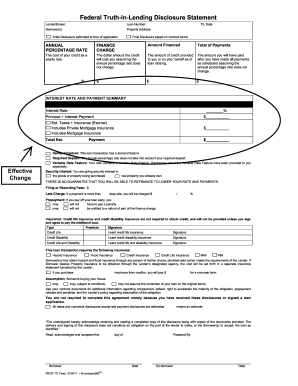

Financial life insurance coverage is going to be a wise choice for a good Va debtor, that can be worth investigating. Which have financial insurance isnt good Virtual assistant requirements and you can wide variety to a completely individual selection. Good Virtual assistant-qualified borrower can obtain good Va mortgage rather than home loan life insurance policies once they prefer, even if an effective Va bank may strongly recommend they into the debtor. Ultimately, the decision lays towards debtor, in addition to debtor is invest the expected dedication to putting some top choice and you may discovering the right merchant once they decide to get mortgage term life insurance.

ENG

ENG