American people collectively features compiled almost $32 trillion home based collateral, depending on the current studies from the Government Set aside. So it shocking contour stresses the significant possible one to home guarantee stands for both for property owners and you can financial advantages similar.

For the average financial-carrying homeowner looking at an equity risk worthy of up to $three hundred,000, you will find a great deal of options would love to feel stolen. Meanwhile, total credit card debt attained an alternate list high of $step 1.thirteen trillion throughout the fourth one-fourth out-of 2023, with respect to the newest House Financial obligation and Credit report regarding the Federal Put aside Lender of brand new York.

From this background, the mortgage Bankers Association predicts that more than the following two years, a can find highest demand for debt consolidation reduction, translating into a whole lot more family collateral lending. Having people holding significant amounts of personal credit card debt and generous collateral built up inside their house, there clearly was a mature chance of mortgage pros to step-in and offer choice you to definitely power domestic collateral to deal with this type of economic challenges.

Customized suggestions

One of the primary measures to influence domestic collateral effortlessly is explaining to your visitors the many sort of family guarantee financing readily available and how they disagree. A couple common solutions were household equity loans and you may house collateral contours of borrowing (HELOCs).

- House guarantee mortgage. Labeled as next mortgages, home collateral fund allow it to be people in order to obtain a lump sum payment off currency up against the guarantee in their home. These money typically come with repaired interest levels and you can monthly premiums, making them a predictable option for individuals.

- Home guarantee personal line of credit. A special a property collateral financing, a great HELOC features in a different way out of a traditional second mortgage. HELOCs additionally use the fresh borrower’s domestic security since collateral, nonetheless it works more like credit cards or rotating range from credit, allowing people so you’re able to borrow on their house equity as required. HELOCs will include adjustable interest rates, giving freedom and a danger of interest rate action.

Whenever advising website subscribers toward house guarantee lending products, its important to perform an intensive evaluation of their financial situation, demands and you may requires. Particular readers could be trying combine high-focus personal debt, although some is generally trying to find funding family renovations otherwise layer highest expenses, instance tuition otherwise medical expense.

You could tailor your recommendations consequently and gives custom information one aligns employing economic needs. For example comparing the pros and you will disadvantages of various home collateral loan alternatives and you can deciding and this solution better matches the clients’ means.

Smart solution

A property equity loan tends to be a smart services for readers seeking a lump sum payment of money to own a particular goal, for example financial support a home repair venture otherwise level a massive costs. In place of additional options, a home collateral mortgage brings borrowers that have a-one-date lump sum payment.

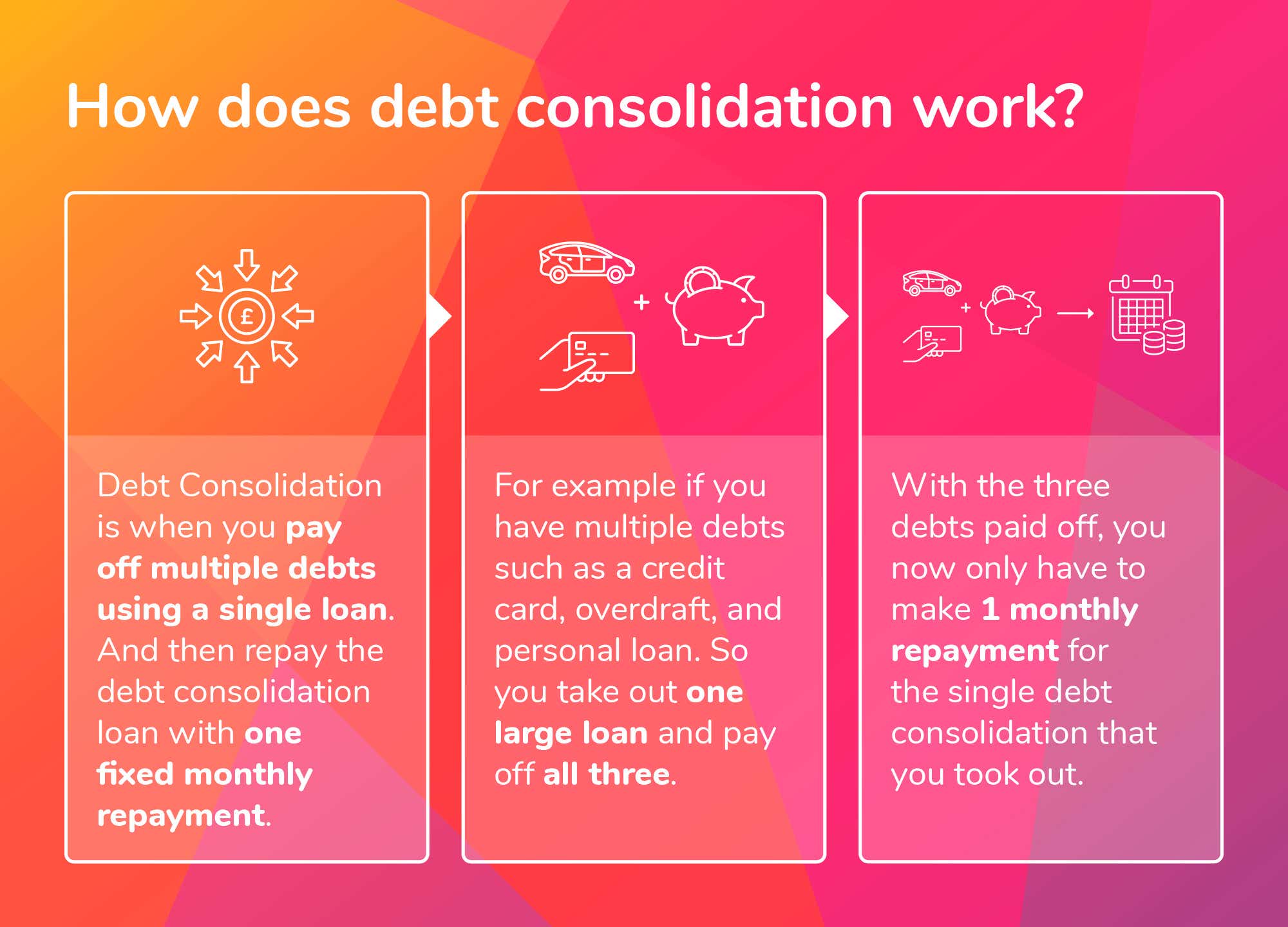

A property guarantee loan can the right option for paying off loans. It provides consumers having a set loan amount of money one are often used to consolidate and you will repay large-focus debts, like charge card balances, unsecured loans or medical expenses. It lump sum payment allows consumers so you’re able to improve the obligations money with the that down month-to-month cost, probably on a reduced interest than just the existing expense.

Let me reveal an example to look at: A person having a great $300,000 first-mortgage in the an effective step three.5% interest rate desired assistance from his large financial company to help you tap some away from their residence’s equity. The broker recommended an excellent $95,000 fixed-rates house collateral loan on 9%, enabling the client to handle higher-interest credit debt and you can money family home improvements.

Even after the additional loan, the newest buyer’s blended mortgage rate resided interestingly reasonable on cuatro.82%. Which illustration shows the possibility benefits of using home guarantee inside the consumer talks. They helps guide you leveraging household equity can offer diverse positive points to customers if you’re bolstering their complete financial health.

Extreme possibility

New generous buildup from home collateral one of Western homeowners gift ideas good high opportunity for both home installment loans online in Missouri owners and you can home loan advantages. Which have nearly $32 trillion home based collateral available additionally the growing difficulty away from record-high credit debt, you will find an obvious demand for debt consolidating choice.

Home loan masters can enjoy a crucial role in handling such financial demands through providing tailored possibilities one influence home security effortlessly. By understanding the all types of house equity finance and you will carrying out thorough examination regarding clients’ demands and you can needs, financial professionals also provide custom advice and you can guidance.

Should it be investment family renovations, coating higher costs or merging highest-appeal debt, house equity financing provide a versatile provider having homeowners. While the mortgage masters navigate the home security land, they could create a significant influence on their clients’ economic better-are and construct long-lasting relationships based on believe and you may expertise. ?

Publisher

Kim Nichols are captain 3rd-team origination design administrator and manages all the representative and you can non-delegated correspondent development during the Pennymac. She also offers more than three decades of expertise in numerous mortgage financial services section, including investment avenues, operations, underwriting, and you may borrowing round the every design channels. Nichols joined Pennymac in 2011 as part of the core leaders people faced with building the foundation for just what happens to be the fresh biggest correspondent investor in the nation.

ENG

ENG