Mix collateralization is the process of having fun with equity from 1 loan since coverage to possess an additional mortgage(s). You’ll find very few benefits of mix collateralization into customers, and it is will a great misused solution to multiple stand alone money due to help you use up all your-of-facts. Always speak to a large financial company regarding the individual condition. Bluish Fox Financing try experienced home loans. We’re prepared to make it easier to know how cross-collateralisation work, how it pertains to your, and you will what get across-collateralisation does for the possessions investment. If you would like see about that it state-of-the-art question, get in touch with all of our experienced broker group now; we will be able to walk you through what you and make certain your understand it all!

Get across collateralization can be utilized any day a few properties try inside and the collateral in one must re-finance/get the second or personal loans for bad credit Nebraska third possessions. A common problem in which mix collateralization happens happens when a home owner desires to explore collateral within holder-filled household to shop for an investment property. Having fun with mix collateralization, the borrowed funds configurations for this circumstance will appear in this way:

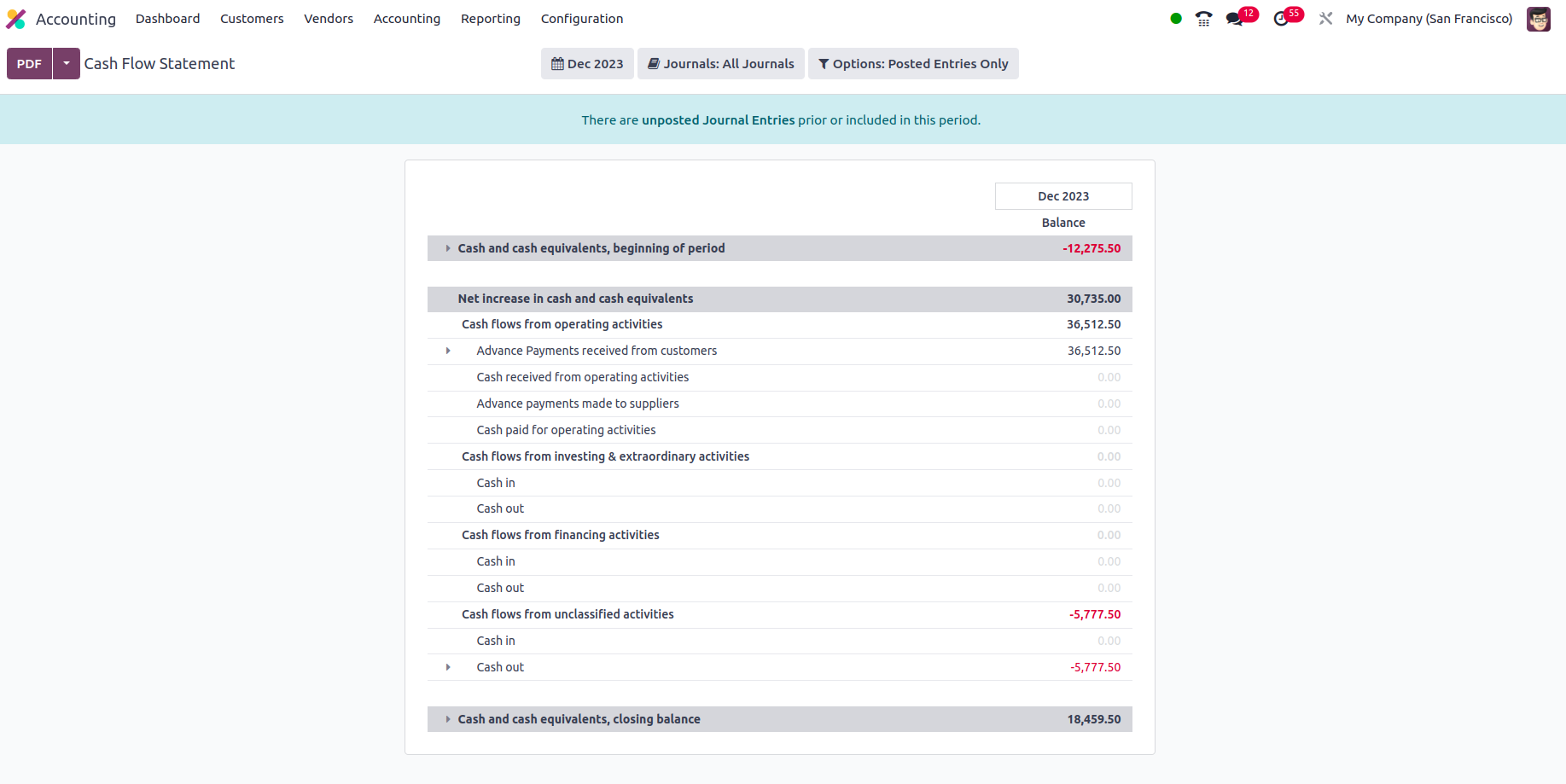

This is what Cross Collateralization turns out

This is certainly a simple, yet prominent, instance of mix collaterlization. So much more complicat issues exists whenever more than several functions are concerned, nevertheless the exact same beliefs apply.

For the nearly all circumstances, your own funds will likely be setup because the ‘stand-alone’ fund (i.age. the alternative out-of mix collateralization). This will look more challenging and be far more confusing, however, has many experts – specific instances below.

Note: The particular owner-filled home is defense for 1 loan, that have a couple of splits, one of which need to be capital. The borrowed funds kind of must legitimately getting laid out from the aim of the mortgage, perhaps not the security. While there is $100,000 security on owner-filled possessions to find this new investment property, it needs to be settings once the a financial investment split. This really is in addition to the cause we have to configurations step 3 financing accounts/splits.

The advantages & disadvantages from Mix Collateralization

I am an enthusiastic believer than just sit-alone fund is the answer into the 95% away from factors. The benefits and you may downsides regarding get across collateralization is actually:

The actual only real true advantage of mix collateralization would be to help save $two hundred, but can ask you for hundreds of thousands of dollars along the tune. I recommend constantly avoiding mix collateralization but regarding the following circumstances:

- Where the full LVR is around 50% while won’t need to access collateral once more. In this instance, chances that the downfalls of get across collateralization apply to youre most thin.

- Occasionally, financial institutions will provide best interest levels getting financing that are get across collateralized (Amplifier is an excellent analogy). The danger may be worth the fresh prize. Very banking institutions may have a good banker pitch they «For those who secure the financing that have each other services, we could make you a better price», however their rate of interest is founded on overall borrowings and LVR – and does not change in the event the framework are sit-by yourself (it generates the bankers occupations much easier even when).

How Mix Collateralization can affect brand new purchases away from property

A corner collaterlized options can prevent this new sales of a home, otherwise result in LMI charges (in the event the moving they more than 90%), otherwise require a funds share. This can always be eliminated if it is settings precisely. Here’s an example of when a corner collateralized configurations helps make it problematic to offer property:

Just how Mix Collateralization may affect the collateral

When trying to gain access to equity within the property, cross collateralized funds decrease the amount in specific facts. Select less than instances:

Simple tips to lose Cross Collateralization

Many people looking over this are making an effort to work out how to remove get across collateralization. At Blue Fox Funds, you want to ensure it is as facile as it is possible for our clients to eradicate mix- collateralisation if they choose do so. Definitely, this really is easier said than done, and dealing to you to know exactly how cross-collateralisation functions is a big help your taking power over they. How is to refinance and set within the same scenario given that stay-alone financing with your neww financial. We could essentially undo cross collateralization to you of course you satisfy the next criteria:

ENG

ENG