Contributor

Mezzanine credit was positioned for a huge season, especially in the true estate sector, as the elder lending continues to slow in the course of monetary suspicion and decreasing house viewpoints. Increased rates of interest possess diminished a house opinions by normally given that 25%, and you may a standard feeling of economic suspicion has many elder loan providers sitting on the sidelines although some significantly tighten its lending criteria. 1 Predicated on J.P. Morgan, mortgage origination regularity have stopped by more or less fifty% out-of last year. 2 At the same time, a projected $step 1.2 trillion away from financing are set in order to adult inside the 2024 and you may 2025, and most recent levels of elderly lending normally absorb just a minority of that regularity. step three Of several current borrowers find themselves in or on the brink regarding a capital shortfall. And you will potential customers is impression the pain sensation also. Senior restrict financing-to-really worth ratios keeps fell so you can 55% or lower, making of many would-feel buyers that have a significant gap throughout the capital bunch.

Mezzanine lending fills one to pit. Title comes on structural identity to have an advanced facts of a developing positioned between one or two first reports. For example their structural counterpart, an effective mezzanine loan sits throughout the financing construction between collateral and you will senior financial obligation. As the pit anywhere between equity and you will senior loans expands, the fresh new demand for mezzanine credit increases. Market conditions introduce a special chance for mezzanine loan providers. If you’re mezzanine financing involves greater risk than just elderly lending, the danger is mitigated as the bucks circulates or any other doing work basics basically remain solid. The decline in home philosophy has been driven principally by highest rates of interest, perhaps not decreased basics. 4 Thus, amid increasing need for under funding, mezzanine lenders can also be get Sherwood Manor loans premium interest levels if you are experiencing the protection away from sooner or later voice security. 5

Owning a home trusts (REITs) are among the market members positioned to fulfill new increasing request to own mezzanine credit. Although many REITs run home security, of numerous buy a home-related loans such as for instance conventional mortgages and mezzanine finance. To own tech factors, not, REITs aren’t an organic fit for the new mezzanine credit area. The guidelines and you can laws that govern REITs do not explicitly contemplate mezzanine financing, while the current suggestions on the Irs (IRS) was at odds that have common mezzanine credit practices in a lot of crucial areas. With demand for mezzanine fund increasing, the latest Irs have a chance to let prevent a capital drama because of the updating their REIT mezzanine credit recommendations, and thus unlocking a much-required source of additional funding.

(a) will bring a short primer towards mezzanine credit; (b) summarizes the current advice from the Internal revenue service off REITs just like the mezzanine lenders; and you will (c) discusses advised updates to the present Internal revenue service guidance.

Mezzanine Credit

Mezzanine lending is a particular sorts of using or second-lien resource. Antique second mortgage loans dropped away from like regarding the aftermath out of the 2008 economic crisis, whenever each other lenders and you will consumers turned all of the as well aware of the drawbacks and you can complications, and mezzanine lending came up because the well-known substitute. The defining difference between antique 2nd mortgages and you may modern mezzanine money is based on the type of your own equity. The next mortgage try secured of the good lien on the subject a home. Another home loan company agrees so you’re able to subordinate the lien compared to that of first mortgage bank pursuant to an enthusiastic intercreditor contract, therefore the first-mortgage financial will get paid through to the next home loan company. Very, both loan providers share a similar guarantee and contractually determine the fresh parameters of their relationship.

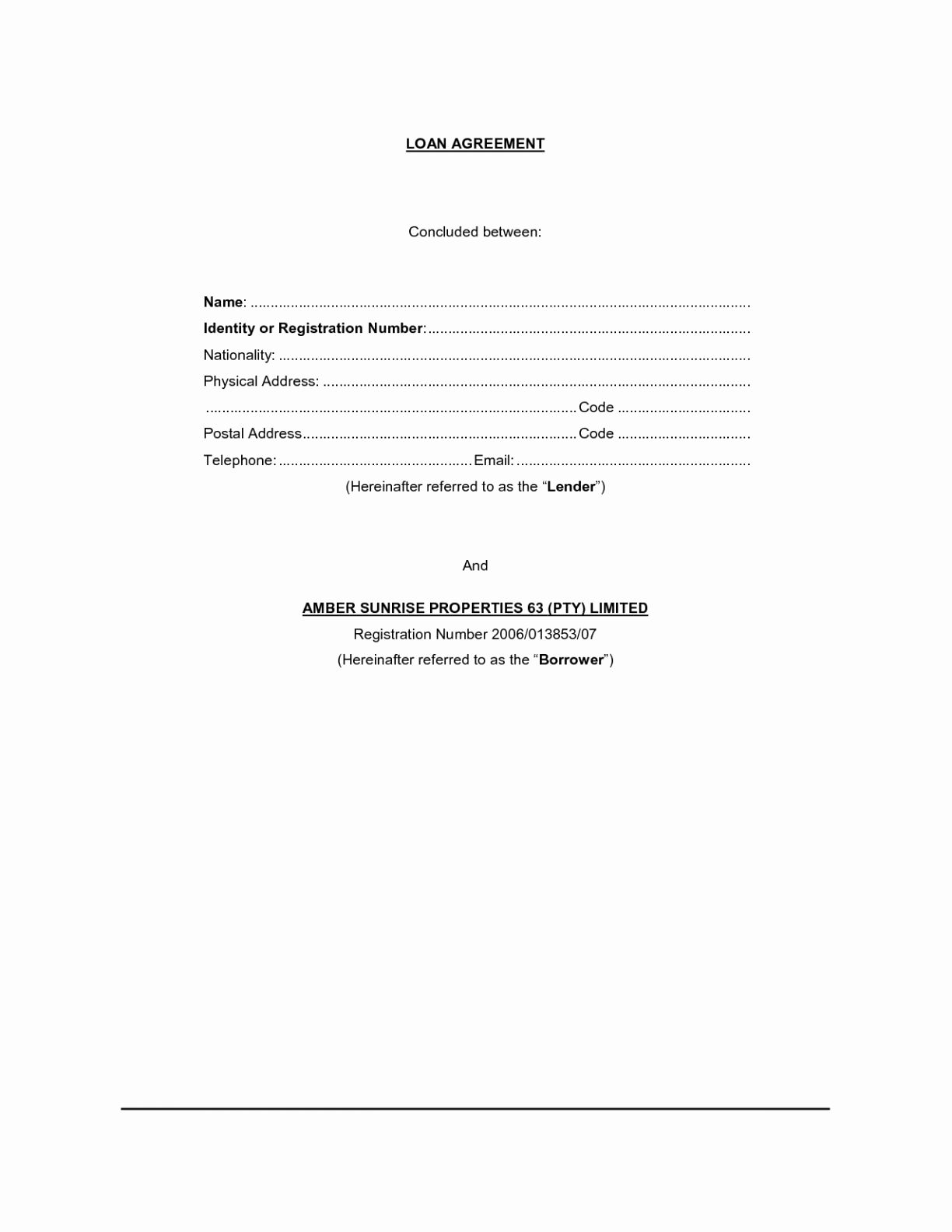

Mezzanine loans, as well, are generally shielded from the a hope of one’s collateral interests inside the new organization you to possesses the niche a property. six New elder lender takes good lien close to the niche a home, just like the mezzanine lender’s lien is but one peak taken out of this new a property on the business structure. A standard mezzanine financing structure appears something similar to it:

ENG

ENG