Are you perception weighed down dealing with numerous loans payments per month? In case the family does not keep far really worth but you are interested in an approach to mix the money you owe, a non-QM 95% LTV debt consolidating Re-finance is what need. This article will be here to really make it easy for you to definitely score everything about this refinancing choice-the goals, the way it works, as well as how you can be entitled to they in the 2024. Let us go into they!

Teaching themselves to Carry out Debt which have a low-QM 95% LTV Financial obligation-Integration Re-finance

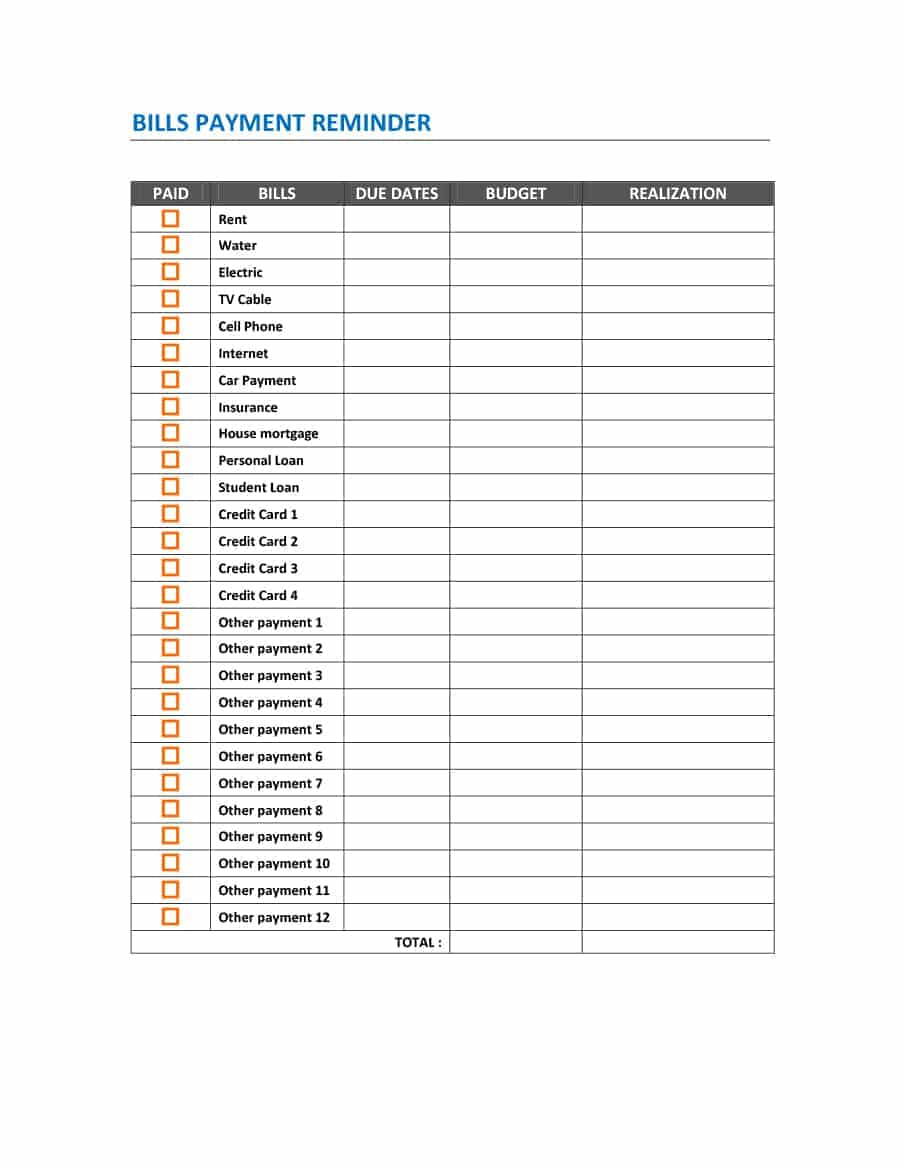

Spending a mortgage is a significant contract for many because it’s the premier bill men and women have every month. This type of lenders was indeed spread out more three decades in order to help make your handbag simpler. But there is more than simply our home. A lot of folks has most other bills, as well like credit cards, vehicles costs, or unsecured loans. Put them all together, & most currency fades monthly.

Living from just one paycheck to a higher is quite popular, even for people that make decent money. Trying safety all of your current debts should be difficult just after taxation or any other content score taken out of your income. Make payment on minimum to the playing cards, which merely covers the eye, barely lowers the debt.

Consider auto money, which happen to be up to $400 thirty days for some. It is an enormous amount of cash, especially when your evaluate they from what you borrowed on the family. You to $400 month-to-month feels like a supplementary $80,000 on the financial.

But there’s a remedy. It is called Low-QM 95% LTV Financial obligation-Combination Refinance. Allowing you re-finance your residence mortgage to pay for all your expenses, bundling them towards the one. That way, you wind up that have one, straight down payment that will save a pile of cash. Consult The Loan Officer to have Mortgages having Poor credit

What’s Non-QM 95% LTV Personal debt-Combination Refinance?

A low-QM 95% LTV Loans-Combination Re-finance was another type of form of mortgage for individuals with limited equity in their home. For those who very own lower than 20% in your home, which loan might help your away. As opposed to searching for numerous domestic security for taking dollars away, that it mortgage lets you acquire up to 95% of one’s residence’s worthy of.

Using this type of refinance, you could potentially move all expense, such as what you owe for the credit cards, auto loans, and personal fund, towards one single loan. This means you may have one homeloan payment in the place of having to juggle multiple payments each month. Its a means to describe lifetime and you will save money on those individuals pesky interest rates and fees.

Cash-Aside Refinance mortgage Direction having 2024

If you want to have some cash out of the home’s worthy of, exactly how much you have made hinges on your residence’s guarantee. Let me reveal a straightforward dysfunction according to research by the style of mortgage:

- FHA Fund: With your, you can borrow doing 85% of residence’s worth. It means you ought to have paid back about fifteen% in your home.

- Antique Finance: You could use to 80% of the house’s value, and that means you need to very installment loans Hawai own 20% of your home.

- Virtual assistant Finance: When you find yourself a veteran, you happen to be lucky since you may use as much as 100% without minimal guarantee requisite.

And there’s which cool the option known as Low-QM 95% LTV Personal debt-Combination Refinance. They allows someone with just reduced 5% of its home consolidate the loans minimizing the monthly obligations.

Debt consolidation against. Cash-Away Refinance

Knowing the difference in bundling the money you owe together and you will delivering bucks from your own house’s value is vital. Of numerous lenders select combining your financial situation to the you to definitely because a type off extract currency from the home’s guarantee. After you pull cash-out, you can utilize that cash for anything-instance paying off your debts, upgrading your residence, to get a unique possessions, or layer large will set you back such as for instance wedding events otherwise medical care.

ENG

ENG