- The credit commitment huge difference: Mention how effortless it is to become listed on together with differences when considering credit unions and you will financial institutions.

- Unraveling the mythology: I facts-evaluate some common misunderstandings from the borrowing unions, off their records on the concepts.

- Monetary benefits of borrowing from the bank unions: straight down financing rates, NCUA insurance coverage and you may representative possession.

Try borrowing unions easy to sign-up? Exactly what are some differences between credit unions against. banks? The audience is reacting this type of or any other well-known questions relating to borrowing unions.

Banking institutions and you will borrowing from the bank unions are created to help individuals do the money. But that does not mean one another types of creditors was cut from the same content. Off their key thinking and concepts to their mortgage prices and you will consumer positives, there are a few large differences when considering larger banking companies and you can credit unions.

Fact: Credit unions have been in existence for a long period.

The original U.S borrowing from the bank commitment is actually St. Mary’s Collaborative Borrowing from the bank Association inside the Manchester, The Hampshire, and that established into the April regarding 1909. step 1 Wilderness Financial short term loans Northwest Harwinton Connecticut (to start with Arizona Academic Relationship #1 Federal Credit Connection) is chartered merely thirty years after ward, which makes us among the many earliest Arizona borrowing unions!

Fiction: Borrowing from the bank unions are just like banking companies.

When you are each other finance companies and you may borrowing from the bank unions make it easier to take control of your funds, their concepts did not be much more different! Borrowing from the bank unions particularly Wilderness Monetary aren’t-for-money, if you’re banking companies are usually for-profit groups. Which means banking companies is concerned about earning more cash because of their shareholders, whereas borrowing unions surrender to their users, the community as well as their people.

Fact: Youre more an associate, youre part-owner.

It may sound crazy, however, this one’s correct! While financial institutions has actually shareholders, borrowing from the bank unions try belonging to their people. When you sign-up a card relationship, your beginning deposit ($twenty-five on Wilderness Monetary) is the show from the credit union. As a member, you may have personal the means to access the credit union’s products, or other advantages!

Fiction: Credit unions are difficult to become listed on.

Section of what makes a cards partnership book is that its professionals most of the show a world popular thread, known as the borrowing unions World of Membership or FOM. A card unions FOM ‘s the courtroom concept of who’ll sign up. An average bond could be your boss, the newest geographic place away from where you happen to live, works, praise or sit in college, otherwise subscription within the a team such as for example a labour relationship. To not care in the event, if you don’t eventually go with a particular credit union’s FOM, but have a family member that would, you also is generally entitled to register!

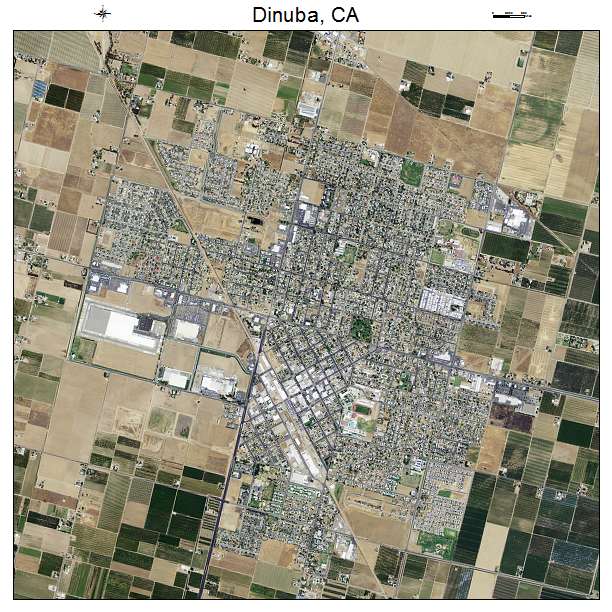

Wilderness Monetary properties each one of Washington (but Apache, Graham, Greenlee and you can Santa Cruz counties) that have a field out of subscription open to anyone who lifetime, really works, worships, volunteers, otherwise attends university in our membership coverage urban area, or perhaps is a primary cherished one regarding a recently available Wilderness Monetary user! 2

Fact: Borrowing from the bank unions will often have lower loan cost than simply banking institutions.

On average, borrowing unions give all the way down rates into home guarantee, car purchase, conventional household and you can home refinance loans. However they will pay professionals high rates of interest towards the put accounts such offers, currency places and coupons certificates, to help you earn more income about what you really have. The fresh new NCUA provides a card Commitment and you will Financial Price testing regarding put and loan costs, in order to observe how it pile up.

Fiction: Your bank account is not as safer in the a cards partnership.

The money within your savings account, savings account or other put levels are insured for as much as no less than $250,000 for each and every personal with the membership on one another financial institutions and you will borrowing from the bank unions. The real difference is actually where federal team provides your money. Credit unions for example Wasteland Monetary are covered because of the National Borrowing from the bank Connection Government (NCUA), while banks was insured from the Federal Put Insurance coverage Corporation (FDIC).

Fact: Borrowing from the bank unions can save you currency.

Borrowing from the bank unions spend a lot of your energy wanting brand new a method to surrender on their people. Since your success is their victory, of a lot borrowing from the bank unions bring economic education resources to save yourself money and you can create obligations.

Fiction: Credit unions commonly as the tech-experienced as banking companies.

It turns out that borrowing from the bank unions not merely have a similar on the internet and mobile financial technology while the large finance companies, they really have most useful of those. Credit unions also offer con cover development such as for example text alerts for unusual deals, together with on the internet costs shell out properties, 100 % free cost management devices, economic literacy webinars and other technical and come up with handling your finances simpler.

As they suffice an identical function, there are many distinct differences when considering financial institutions and you may borrowing unions. Since they are affiliate-had cooperatives, credit unions put the professionals earliest! Borrowing from the bank unions are known for providing to the city thanks to volunteering, scholarship applications, fundraising, donations and more. Within Desert Financial, that’s what we label Sharing Achievement – and it’s really one of the primary causes the audience is pleased to-be a cards relationship!

ENG

ENG