step 3. Imposition away from charge. A creditor might not, payday loans Mountain Village CO online in just about any facts, demand a charge so you can reinstate a personal line of credit because updates has been calculated not to can be found.

4. Reinstatement out of borrowing rights. Loan providers have the effect of making sure borrowing from the bank privileges are recovered because in the near future due to the fact fairly you are able to pursuing the status you to let the fresh new creditor’s action stops to exist. A good way a collector will meet it duty should be to display new line into an ongoing foundation to decide if the status ceases to exist. The fresh collector need certainly to investigate the problem frequently sufficient to to make certain in itself that the updates enabling the fresh new frost continues to are present. Brand new volume with which new creditor need take a look at to decide whether a condition continues to are present varies according to the particular reputation helping the latest freeze. As an alternative to such as for example keeping track of, the creditor get change the duty for the consumer so you’re able to demand reinstatement regarding borrowing from the bank privileges giving a notification relative to 1026.9(c)(1)(iii). A collector might require a great reinstatement demand to settle creating if it notifies an individual in the requirements towards the see considering not as much as 1026.9(c)(1)(iii). Because the individual desires reinstatement, the creditor need to punctually read the to decide whether or not the position enabling new freeze continues to can be found. Around that it option, the new collector has an obligation to research just through to the brand new client’s consult.

Eg, assume that property having a primary home loan out-of $fifty,000 are appraised on $100,000 and the credit limit try $31,000

5. A creditor may prize a particular consult by a customers to suspend borrowing from the bank privileges. If for example the individual later demands the collector reinstate credit privileges, the newest creditor need to do therefore provided hardly any other circumstance justifying good suspension system can be found at the time. If the two or more ?ndividuals are required less than an agenda and you may per can bring enhances, the brand new contract will get allow any of the users to help you head the collector never to build next improves. A collector need that most individuals required lower than a strategy demand reinstatement.

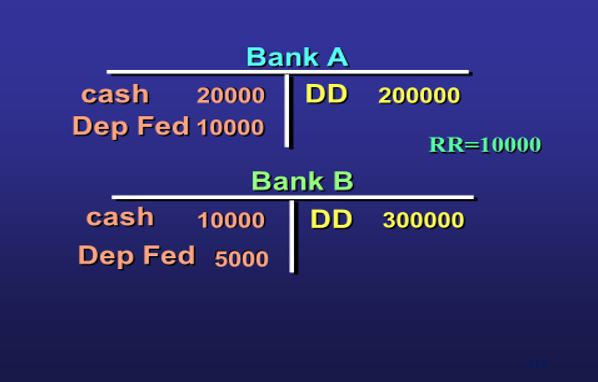

6. Extreme refuse laid out. What constitutes a serious decline for purposes of (f)(3)(vi)(A) are different centered on personal products. Anyway, in the event the worth of the dwelling refuses in a manner that the original difference in the financing limitation in addition to offered security (in line with the property’s appraised worth having reason for the program) was faster by 50 percent, so it constitutes a life threatening lowering of the value of the structure to own purposes of (f)(3)(vi)(A). The essential difference between the credit restriction and the readily available equity are $20,000, 1 / 2 of that’s $ten,000. The new collector you are going to exclude next advances otherwise reduce the credit limit in the event your value of the property declines off $100,000 so you’re able to $ninety,000. That it provision doesn’t need a collector to find an appraisal ahead of suspending borrowing rights although a critical refuse need can be found prior to suspension system can happen.

Or even prohibited of the county rules, a collector can get collect simply bona-fide and you can realistic assessment and you may credit report fees if the such as for instance costs happen to be obtain inside exploring whether the position permitting new freeze will continue to exist

seven. Question change in economic factors. Several criteria should be satisfied for (f)(3)(vi)(B) to utilize. Earliest, there should be an excellent situation change throughout the consumer’s economic points, particularly a critical reduced amount of new customer’s income. 2nd, this is why transform, the newest creditor should have a good religion that consumer commonly not be able to satisfy the commission obligations of one’s package. A creditor get, but shouldn’t have to, rely on particular proof (including the incapacity to expend almost every other costs) in finishing that second the main attempt could have been met. A creditor can get prohibit next improves otherwise slow down the credit limit below so it area in the event the a consumer data to own or is set inside the bankruptcy.

ENG

ENG