When you look at the Tulsa, many financial apps are around for address additional financial needs and you may homebuyer facts. The following is a closer look in the some of the prominent alternatives:

Such funds render favorable terms minimizing down payments, leading them to a good choice for people that meet the requirements

Such financing offer several benefits, together with advantageous terminology, zero dependence on an advance payment, and no importance of individual financial insurance coverage (PMI). This is going to make them ideal for those who qualify, taking extreme cost savings and you will accessible home financing.

Traditional LoansConventional finance commonly supported by one bodies company, in lieu of Va or FHA loans. They generally feature fixed interest rates and versatile terminology, and that is tailored to suit certain monetary points. Although not, they generally require high fico scores and you may big down payments opposed in order to Va funds. Conventional funds is actually a well-known choice for individuals who meet up with the borrowing and deposit standards.

FHA LoansFHA financing is insured because of the Federal Homes Management and you will are designed to let individuals that have straight down fico scores and you will smaller off money. This type of money are great for basic-go out homeowners otherwise people who have faster-than-finest borrowing from the bank, and work out homeownership far more possible. The insurance available with new FHA support decrease financial chance, enabling much more available loan terms and conditions.

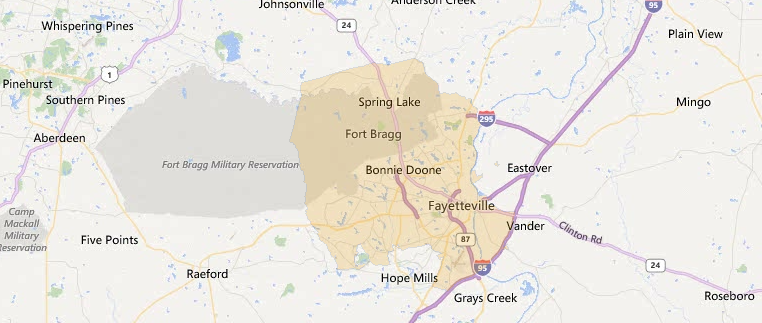

USDA LoansUSDA finance are intended having homebuyers in the rural elements and provide the benefit of zero deposit. Supported by the us Company away from Agriculture, these types of financing are a good selection for those individuals thinking of buying a house in the qualified outlying and you will residential district portion. Having https://cashadvancecompass.com/payday-loans-in/ less an advance payment requisite can also be significantly slow down the upfront can cost you of getting a house.

Point 184 LoansSection 184 fund are designed particularly for Native Western homebuyers. The applying is designed to render homeownership in this Local American groups because of the offering accessible and you can sensible investment selection.

Refinance LoansRefinance fund create homeowners to modify their existing home loan terms and conditions or rate of interest. This is exactly a way to remove monthly obligations or reduce the loan identity, possibly saving money over time. Refinancing are going to be a strategic financial disperse if interest rates has decrease or if you need certainly to improve your loan’s framework.

Investment property LoansInvestment possessions fund are targeted at to invest in features to have local rental or financial support objectives. This type of loans are designed to assistance a residential property investors trying to acquire local rental homes and other financial support properties.

2nd Domestic LoansSecond home loans are widely used to buy trips home or extra homes. These types of loans can have other criteria compared to loans getting first houses, highlighting exclusive means and you will economic pages out of 2nd-home buyers. They give a chance for individuals to own numerous characteristics.

Jumbo LoansJumbo loans is designed for large-costs attributes one to exceed the fresh compliant mortgage constraints set from the regulators providers. This type of financing normally feature more strict criteria but promote competitive pricing getting larger financing amounts. He’s perfect for customers trying to fund more expensive functions.

They often come with various other conditions and terms versus simple mortgage brokers, showing the new funding characteristics of the property

Down-payment Guidance ProgramsDown payment recommendations apps are designed to let first-time homeowners which have gives otherwise reduced-attention money to afford down payment. These applications try to make homeownership way more available through the elimination of the brand new monetary burden of your own deposit, enabling more people to invest in its basic household.

First-Time Family Visitors ProgramsFirst-date homebuyer programs offer unique advantages such as for example straight down rates or advance payment guidelines. Such programs are customized to aid the fresh customers enter the homes field with an increase of good financial support words, putting some procedure of to order an initial house easier plus sensible.

ENG

ENG