A conventional financial is a type of home loan this is not part of a national system and you may isn’t supported, covered, or protected because of the national.

?? Skills old-fashioned mortgages

A traditional home loan was home financing that isn’t insured because of the government entities – If your debtor defaults (cannot or cannot pay it back), government entities would not protect the financial institution facing losings. This is why improved risk, traditional mortgage loans usually are more challenging discover acknowledged. Generally, antique mortgages is actually provided by the individual lenders such financial institutions. They can be divided in to 2 types: conforming and you can low-compliant fund. Compliant money proceed with the requirements and conforming financing limitations provided of the Fannie mae and you may Freddie personal loans online Mac (several bodies groups one buy mortgages out-of lenders right after which offer him or her on the open market just like the financial recognized bonds). Non-conforming funds dont be eligible for buy of the Federal national mortgage association and you will Freddie Mac.

Consider good homebuyer, Jane, who wants to pick a property. This lady has a choice between taking out fully a low-traditional loan, such as an enthusiastic FHA or Va mortgage, which will be simpler to qualify for, otherwise a normal financing and is harder to track down recognized. Because the Jane enjoys a good credit score, a top income, and generally good monetary position, she decides to opt for a traditional compliant financing (the one that fits Fannie Mae’s and Freddie Mac’s requirements). Jane applies, will get recognized, that will be on her behalf way to to purchase her new home.

Takeaway

For many who book an apartment off a property owner, therefore the property manager doesn’t have book guarantee insurance rates, he’s got zero shelter for many who stop expenses your own lease. For this reason, landlords should be extra careful in the exactly who they take on while the clients. Similarly, in the a traditional financial, the loan actually covered from the government, so it can be more challenging to track down recognized.

Clients need certainly to join, become approved, and hook up its bank account. The money property value the inventory benefits might not be withdrawn having thirty day period after the prize is said. Stock rewards perhaps not reported in this two months could possibly get expire. Look for full small print in the . Bonds exchange is out there as a consequence of Robinhood Monetary LLC.

- What is a traditional home loan otherwise loan?

- What’s the difference in a traditional mortgage and you may a compliant loan?

- What’s the difference between a normal loan and a keen FHA loan?

- How come a traditional home loan work?

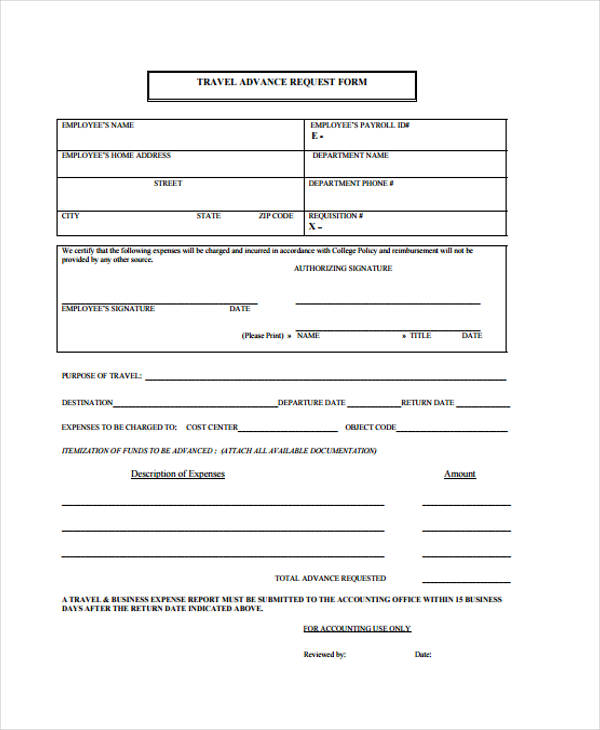

- What is the called for records?

- Do you know the rates of interest to own a conventional mortgage?

- What are the criteria to have a traditional loan?

- Just what credit history would you like to have a traditional financing?

- Who maybe not qualify for a traditional loan?

A traditional financial or loan is home financing otherwise mortgage that is not part of a national program and you will actually insured because of the the federal government. If the borrower defaults, the lending company won’t have government safeguards against losses. This makes antique loans riskier to possess lenders, and therefore makes bringing approved for example more challenging.

Old-fashioned fund can either getting compliant or non-compliant financing. A conforming loan stays inside bounds from Fannie mae and you can Freddie Mac’s credit standards, such as the restriction amount borrowed, when you are a low-compliant financing does not. Fundamentally, the newest costs, conditions, and you can interest rates getting conforming financing be much more standard than others for non-conforming financing. Yet not, due to the fact non-compliant financing don’t adhere to Federal national mortgage association and you will Freddie Mac’s standards and you may limits, individuals can take out huge funds, aka jumbo finance, to invest in more costly residential property.

What’s the difference between a normal mortgage and you will a conforming loan?

A compliant loan is a type of conventional financing. All the conforming finance is conventional money, however the opposite isn’t necessarily true.

ENG

ENG