This rule states that there’s a good chance you’ve found a cash-flowing property if it rents for at least 1% of the purchase price. If you have a specific rate of return you’re aiming for, calculating cash flow for real estate can give you an idea of whether a real estate cash flow property is likely to meet expectations, exceed them or fall short. There’s no set rate of return that’s considered desirable when investing in rental properties. It’s largely subjective, based on the rental market you’re investing in and your individual goals.

Importance of Cash Flow in Real Estate

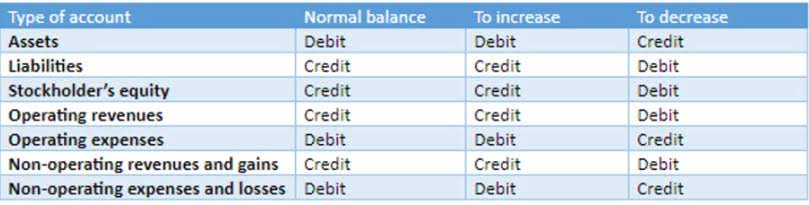

Understanding how much you’re likely to owe in taxes for owning a rental property can give you a better idea of how much of your profits you’re really going to keep at the end of the day. The value of various assets declines over time when used in a business. As a result, D&A are expenses that allocate the cost of an asset over its useful life. Depreciation involves tangible assets such as buildings, machinery, and equipment, whereas amortization involves intangible assets such as patents, copyrights, goodwill, and software. However, we add this back into the cash flow statement to adjust net income because these are non-cash expenses.

What’s the Point of Real Estate Financial Modeling?

- Typically, property taxes are based on an assessment of the market value of a property.

- If you have a specific rate of return you’re aiming for, calculating cash flow for real estate can give you an idea of whether a property is likely to meet expectations, exceed them or fall short.

- Stessa helps both novice and sophisticated investors make informed decisions about their property portfolio.

- It sounds simple enough, but there’s a little more involved in making sure that a rental property is a worthwhile investment.

Past this point, we create a waterfall schedule to split up the cash flows to the Developers and Investors based on the overall Equity IRR. In real estate development deals like this one, Developers often earn higher percentages when the deal’s IRR increases; the waterfall structure incentivizes them to perform well. We will change it a little bit because we plan to boost rents up to market rates by lightly renovating the units. The latest real estate investing content delivered straight to your inbox.

How to create positive cash flow: 3 winning examples

Ultimately, it comes down to your priorities as an investor, risk tolerance, and the market you choose to invest in. The most obvious way to increase cash flow is to increase the amount of rent on your property. Baselane’s rent collection platform is an excellent avenue to stabilize your rental income. Baselane provides automated payment reminders and seamless online payment options to minimize late or missing payments. This ensures timely reception of your rental income every single time.

- And perhaps one of the most important performance metrics to stay on top of is cash flow in real estate because it measures how profitable your property is.

- Integrating the gross income multiplier model in real estate is comparable to relative value valuations with stocks.

- She supports small businesses in growing to their first six figures and beyond.

- You can take loans against your existing property or take a regular mortgage loan.

- The more cash flow a property generates, the more money will be available to redistribute back to investors, thereby increasing the CoC returns.

Because real estate investment is typically not a short-term trade, analyzing the cash flow, and the subsequent rate of return, is critical to achieving the goal of making profitable investments. Discounting future net operating income (NOI) by the appropriate discount rate for real estate is similar to discounted cash flow (DCF) valuations for stock. Integrating the gross income multiplier model in real estate is comparable to relative value valuations with stocks. As mentioned, real estate investors use the 1% rule when considering whether to invest in a property.

Real estate can be an excellent investment – if you know what you’re doing. The rate at which a lender must be paid equals this sinking fund factor plus the interest rate. Gordon Scott has been an active investor and technical analyst or 20+ years. Cash flow may also be used to calculate other metrics like Internal Rate of Return (IRR) and equity multiple. So, let’s take a deep dive into one of the most powerful topics in real estate.

What Is Real Estate Cash Flow: An Investor’s Guide

Given the importance of cash flow in the performance of a commercial real estate investment, it is helpful to understand the factors that impact the amount of cash flow a property produces. After all, a big reason you’re probably in this business is to get a return on investment, and cash flow is a major factor in the buy-and-hold investment strategy. Vice-versa, it’s easier to find a cash flowing property in a cooler market, but rents aren’t high enough to really move the needle financially. Local rental rates and property values play a huge role in cash flow as well. Using the cap rate formula, also known as the capitalization rate, will be beneficial when comparing the potential return on investment among different properties.

Encourage Long Term Tenants

- The growth rates for all of those, especially the income sources, are also important.

- These typically have lower vacancy rates and spread maintenance costs over many tenants, making them much more profitable overall.

- For more about individual properties and how the differences translate into revenue and expenses, please see our detailed article on the real estate pro-forma.

- Additionally, you should try to pick investment properties that don’t require much maintenance.

- A strong accounting foundation is relevant whether you sell small properties as a hobby or facilitate property management services and generate millions of dollars.

- As a result, D&A are expenses that allocate the cost of an asset over its useful life.

This can be a helpful guideline to avoid the time, effort and research needed to evaluate cash flow metrics. However, it doesn’t include other important factors, such as the rental market, cost of living and average incomes in the area around your property. The term “cash flow” is commonly used to describe the amount of money produced by a property. But, this is a general term that ignores some of the more important nuances in commercial real estate analysis. Net Operating Income and Cash Flow Before Taxes are the more specific terms used.

tips for maximizing cash flow in real estate

This cash flow calculation will tell you whether a property is profitable or losing money over time. Get instant access to all of our current and past commercial https://www.bookstime.com/ real estate deals. So, instead of strictly looking at cash flow amounts, you must also look at the ROI on your money, as that’s equally important.

ENG

ENG